Power at the Pinch Point

Pivot or Pitfall?

While solar and wind power have become cheaper than coal power, we’re destined to fail at achieving a climate safe future. Our expedited transition to a low-carbon or net-zero emission economy shows promise with new technologies to use renewable energy and green hydrogen. Developed countries are beginning to utilize electrification and green hydrogen to replace fossil fuels across all sectors, including gas utilities, transportation, and many industries. We are largely overlooking, however, a crucial supply gap: critical metals.

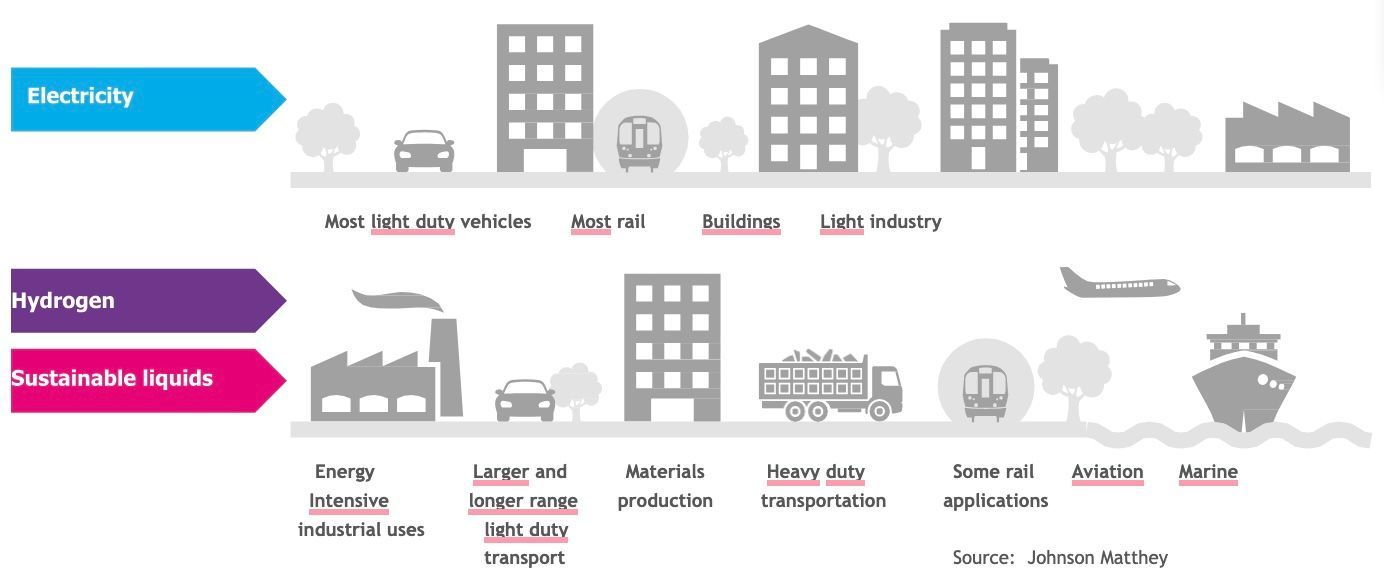

The metals that renewable energy electrification rely on are under supply stress and forecast to reach limits by 2030. Direct electrification is suitable for light duty transport, much of buildings’ energy use, and some light industry. The hard reality is that electrification alone cannot achieve a smooth energy transition. Critical metals are those that are essential for energy technologies, namely copper, lithium, cobalt, nickel, and the platinum group metals (PGMs). Sufficient infrastructure to move electricity to all sites of energy consumption is unattainable; in many cases direct use of electricity is impractical.

Under the

International Energy Agency’s scenario for net-zero carbon emissions, by 2040 the demand for copper escalates by 60 percent; cobalt and nickel demand are projected to more than double, while lithium leaps up ten times. The

data show that the rise of battery electric vehicles and expansion of electric infrastructure drive the higher need for these critical metals.

To keep pace with unprecedented demand for particular critical metals, scaling up supplies rapidly enough faces severe challenges. It’s no secret now that significant market deficits are likely for

lithium,

nickel,

cobalt, and

copper. Near the end of the decade, these shortages are anticipated to strain demand; by 2035 they are forecast to reach supply gaps exceeding 20 percent. While recycling of these critical metals is also expected to grow, the inevitable supply deficits will persist. By 2033, recycled lithium, cobalt, and nickel are merely projected to supply five to 15 percent of battery demand.

That places reliance on mined metals for decades.

Even historic investment efforts to propel primary supply of these metals appear improbable since mining exhibits cyclical growth and requires longer lead times to scale up than the demand curves show.

Meeting the supply gaps poses serious impacts: environmental and social. Does personal mobility justify harmful sea-floor mining? As the world’s largest nickel producer, Indonesia largely relies on coal power, emitting carbon two to six times more than nickel produced from sulphide deposits. The atrocious consequences for communities and their surroundings from Indonesian nickel mining are mounting. Forecasts for BEV use are likely unattainable. The gap in supplies of critical metals and singular dependence on BEVs reveal a risky delay or unhinged path to a climate safe future.

Improving efficiency of critical metals

If efficient use of critical metals cannot enable electrification alone, complementary technologies that use critical metals less intensely and utilize different ones must be anticipated and deployed. Increasing the efficiency of the platinum group metals, such as platinum, iridium, and ruthenium, with more established supply sources and recycling systems than the others becomes crucial to any successful strategy. These critical metals largely serve technologies that can abate emissions in sectors that are the most difficult to decarbonize. The sectors, energy-intensive transportation, large industries (including petroleum refining and steel, cement, and fertilizer production), and chemicals, combine to capture a hefty share of energy consumption.

Since decarbonizing these ‘hard-to-abate’ sectors through electrification is impractical, if not impossible, we will rely on renewable hydrogen and sustainable fuels that either use hydrogen or advanced biofuels.

Alongside electrification, if we deploy green hydrogen-based fuels, fuel cell electric vehicles, hydrogen combustion engines, and bio-based fuels and chemicals, we can largely solve the problems of intermittent supply and transportation of renewable power. At the same time, we will optimize the costs of needed infrastructure.

The underlying question is this: how can the intensity of critical metals use in the energy transformation be reduced sufficiently to achieve the goals of the Paris climate agreement and prevent runaway climate disaster? Although

energy

efficiency and emission reduction are rightly motivating adoption of batteries

and direct electrification, unless we also plan for critical metals efficiency we will fail. If we optimize both of these strategies together we can solve this question and deliver a successful and smooth energy transition.

Since extraction of critical metals is finite and damages the environment, they should be used ultra-efficiently as we already experience supply stress due to electrification. The supply chain disruptions of the COVID pandemic painfully demonstrated that economic resilience is also driving domestic security of critical raw materials, those that are at risk of short supply or supply disruption. Given that the US relies on non-domestic supplies of lithium, copper, cobalt, and nickel for BEVs and electrification, what is the zero emissions vehicle with the highest metal efficiency? It’s the fuel cell EV (FCEV), despite the fact that it contains a small battery pack. The fuel cell stack relies on platinum group metals as the most robust catalysts; recent designs employ minimal platinum to catalyze the electrochemical reactions in the fuel cell. Development of catalyst-embedded nanofiber membranes promises landmark reductions of platinum loading.

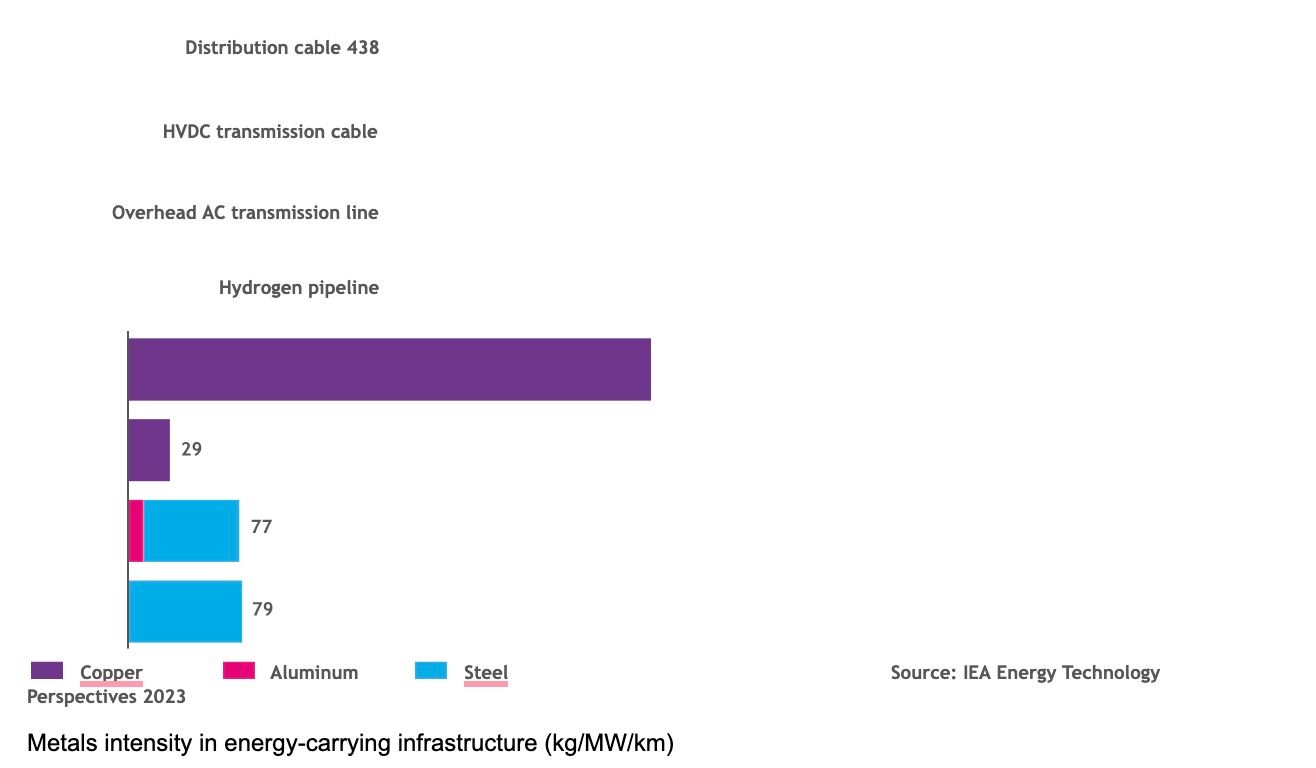

What are the differences in critical metals efficiency in medium and heavy-duty commercial vehicles? According to an assessment by S&P Global of copper content in vehicles with different powertrains, FCEVs are much more copper efficient than BEVs – particularly for the largest vehicles. If we assume that most of the trucks will need to be electrified, hundreds of kilograms of copper in each battery truck would be required. As we move to ‘energy-by-wire’, large amounts of copper will be needed in new cables (see figure below).

Prioritizing efficiency of critical metals directs the best use of technologies for enabling a zero-emissions vehicle fleet that optimizes the balance of energy and critical metals efficiency.